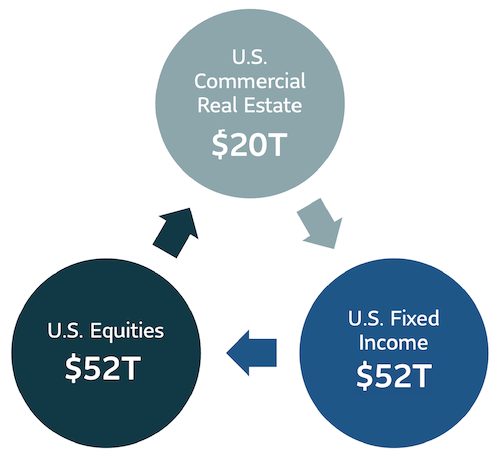

1 https://www.reit.com/data-research/research/nareit-research/estimating-size-commercial-real-estate-market-us-2021

2 Based on historical CPI data from BLS.gov and historical NCREIF return data. Includes data for the period 12/31/1977 - 12/31/2020

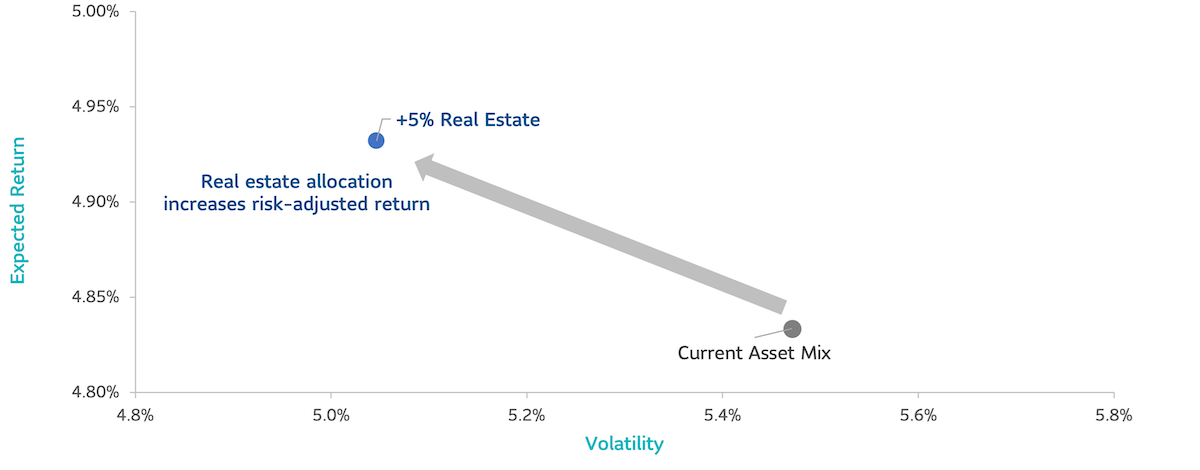

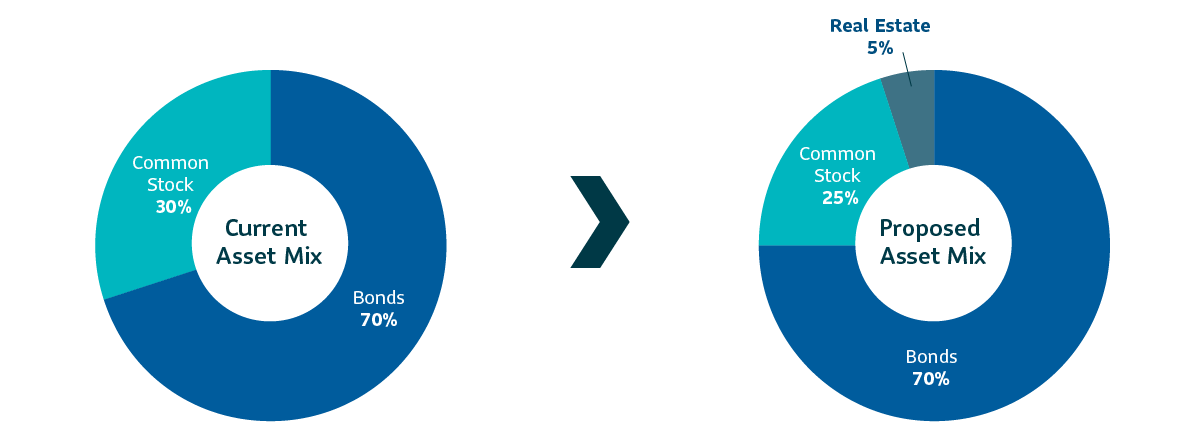

3 For real estate, expected return of 10% is derived from the historical ODCE index returns, adjust for leverage ratio, and volatility of 12% is from Adjusted NCREIF Index.

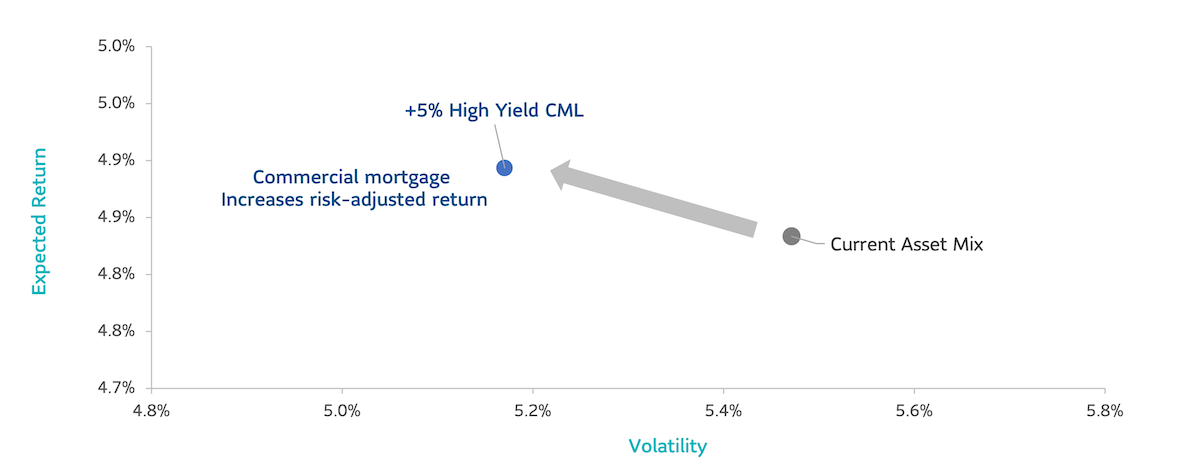

4 For CML, expected return of 9% and volatility of 9% are computed based on historical returns of a blend of CML High Yields indices with adjusted leverage ratios.

This document is intended for institutional investors only. The information in this document is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

NCREIF is an industry trade association that collects and disseminates real estate performance information. NFI-ODCE is an index of investment returns reported on both a historical and current basis for 37 open-end U.S. commingled funds with a core investment strategy. The NFI-ODCE index is capitalization-weighted and is reported gross of fees and measurement is time-weighted. Further information about this index is available at http://www.ncreif.org.

Nothing in this document should (i) be construed to cause any of the operations under SLC Management to be an investment advisory fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

There can be no guarantee that such targeted performance will or can be achieved.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements.

As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Past performance is not a guarantee of future results. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the presentation unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management

SLC-20221102-2462392