Market

Summer is typically the slowest time of the year for the IG private credit market and this year was no exception. Q3’s volume of $13.8 billion was the lowest of the year and closed slightly lower than Q3 2022’s volume of $14 billion. July and August were very slow, but the market rallied slightly in September as issuers and investors returned from vacation and got back to work. Year-to-date market volume of $67.6 billion is behind both 2022 ($71.7 billion) and 2021 ($75 billion) as higher interest rates continue to dampen issuance, especially in the financial and real estate investment trust sectors. Financial issuance is down by 50% year over year. Industrial and utility sector issuance was stronger than the prior year and helped support volume while the transportation sector was lower. Despite lower overall issuance, we believe asset managers are in an environment featuring promising opportunities in solid credits with attractive relative value, with the potential of obtaining favorable allocations this year.

In addition to lower financial and real estate issuance, there have been a few other themes this year that have underpinned IG private credit market activity. One theme is that borrowers prefer to issue shorter tenors rather than locking in today’s rates for longer issuances. While issuance of tenors of five years and shorter has increased, issuance of seven years and longer is down year over year. The other theme is that there have been fewer deals, but much larger issuances. We believe much of the larger issuance is driven by capex or acquisitions as opposed to the opportunistic issuance we saw in prior years due to the low base rates of 2020 and 2021. The number of large issuances ($1 billion or larger) slowed over the summer with only one deal of that size in Q3, compared 10 in the first half of this year.

There have been numerous headwinds that dampened both issuer supply and investor demand starting this spring. Based on our observations and analysis of current market conditions, lackluster insurance product sales contributed to less investable cash flow for some investors. And some issuers, expecting lower rates, have stayed on the sidelines unless they have to get something done.

Outlook

The slowdown in demand seen through the first three quarters of the year may be reversing. For traditional industrial and utility credits, especially new names to the market, the IG private credit market has shown healthy demand, sometimes with over-subscriptions and pricing inside of the tighter end of guidance. For more complicated structures and financial issuers, deals are pricing wider than at any time since 2020 – primarily due to the wave of financial issuers in the past two years. This type of market may call for a disciplined approach, as the relative value and ability to negotiate terms is less consistent across deals than typically seen. We believe this type of environment calls for a selective deployment of capital by asset managers.

While we are cautiously optimistic, the continued rise in bond market yields could negatively impact issuance. On the other hand, with market consensus now tilting toward higher for longer rates, issuers may be motivated to come to market now rather than hope for lower rates in the next few quarters.

In focus: investing in infrastructure

The term “infrastructure” has become somewhat of a buzzword for asset managers seeking to attract clients to an alternative asset class. Asset managers can be quick to point out the potential benefits of infrastructure investing, such as low correlations to public markets or the potential return stability even during economic downturns. However, when asked to define what an infrastructure asset is, we have observed frequent inconsistencies among asset managers and attempts to broaden the definition.

At SLC Management, we describe an infrastructure asset as a long-life, capital-intensive asset that is generally insulated from economic conditions or, at least, can benefit from mitigated revenue volatility. Such assets benefit from high barriers to entry created from a strong, or protected, market position due to: (i) a government granted concession; (ii) industry regulation; or (iii) direct contractual rights.

Due to these characteristics, infrastructure assets can typically benefit from long-term, stable and often contracted cash flows. When we analyze the markets, we typically see assets with the aforementioned characteristics fall into five key infrastructure debt verticals:

Debt verticals |

Examples of types of assets |

|---|---|

Power generation |

Solar and wind farms, |

Energy infrastructure |

Transmission, pipelines, liquefied natural gas (LNG) facilities, |

Transportation |

Ports, toll roads, rail |

Social infrastructure |

Public-private partnerships (“P3s”) for hospitals, justice facilities, |

Digital infrastructure |

Fiber, data centers, cell towers |

For educational purposes only.

We believe that having a clear definition and a sector focus helps ensure investment rigor and prevents the inclusion of assets that may not have the positive attributes listed above that we believe are critical for core infrastructure assets.

Why invest in infrastructure debt?

As investors, we see the following potential benefits of this asset class:

- Diversification – Cash flows are typically either contracted, regulated or based on a monopolistic or dominant market position. As a result, cash flows are generally stable and not typically exposed to economic downturns, and are thus not correlated to other asset classes.

- Asset-liability matching – Given the essentiality of the assets and the stable nature of their cash flows, they can support long-term, investment grade debt investments suitable for asset-liability matching.

- Sustainable investing – Infrastructure debt can be secured by assets that have positive characteristics related to environmental, social and governance (ESG). Examples of investments that focus on the environment include new social infrastructure assets built to high environmental standards (Leadership in Energy and Environmental Design [LEED] certification*) and renewable energy projects that can help reduce overall carbon emissions.

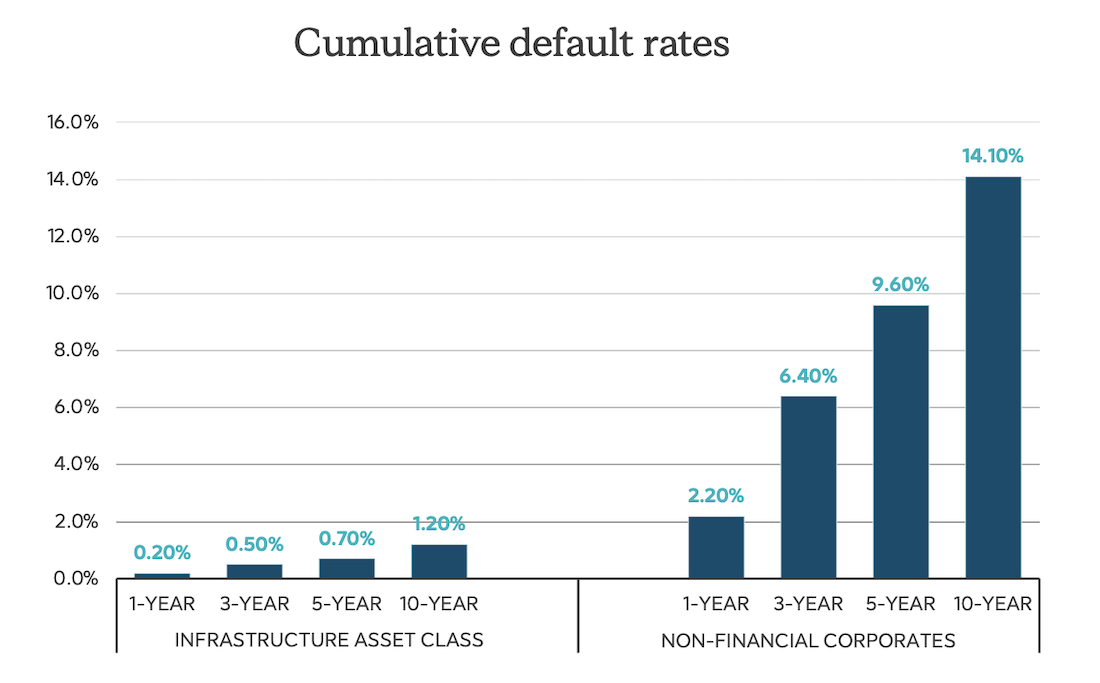

- Lower cyclicality and default rates – We have seen infrastructure debt perform over several economic cycles and during “black swan” events including the “dotcom” bubble, the Global Financial Crisis, COVID-19 and the current inflationary cycle. When looking at default rates, infrastructure debt has performed solidly and more consistently than similarly rated corporate credits. As illustrated by the following chart, historical cumulative default rates for infrastructure debt assets are substantially lower than the broader debt market over nearly four decades.

Source: Moody’s Default and recovery rates for project finance bank loans, 1983-2021. Moody's Investors Services, April 4, 2023.

In our view, low loss rates and diversification benefits, along with the potential for positive ESG attributes, could make infrastructure debt a compelling asset class, but one that is highly sought after as well. This can make asset origination and selection challenging for inexperienced infrastructure debt investors.

Risks of infrastructure debt investing

Despite the potentially positive attributes of infrastructure assets, infrastructure debt is not a risk-free investment. With more investors allocating a portion of their portfolios to infrastructure debt, financings have become increasingly aggressive, and an experienced asset manager may be required to assess and mitigate risks from individual investments. The following are examples of risks investors may encounter in this sector:

- Greater exposure to revenue risk – Historically, renewable projects have been financed against a fully contracted power purchase agreement or a fixed, regulated tariff. Now, most deals have an element of merchant power pricing risk after the maturity of a contract, and in some cases don’t even have any contracts at all. With lower leverage than a contracted asset, it is certainly possible to get to an investment grade rating. However, we believe this requires the appropriate expertise to understand how much leverage is acceptable and at what merchant power price does a project generate sufficient cash flows to cover its debt obligations.

- Higher leverage – Given compelling market opportunities in infrastructure assets, sponsors are now adding additional leverage to projects. Examples include the proven technology of solar panels or the robustness of toll roads during the COVID pandemic. However, how much leverage is too much? It is important to note when recent bias might be tainting an investor’s view on the inherent risks of such deals.

- Greater exposure to greenfield risk – Defined as the exposure to a new asset without a proven track record, greenfield risk often includes construction risk. Examples include a toll road without historical volume or the building of a new stadium. Construction of these new assets could cost more than originally expected or take more time than budgeted. A high level of asset management expertise can help ensure that construction risk is appropriately mitigated, and that debt service is still paid under extreme downside scenarios should the asset be exposed to demand risk.

The previous descriptions are just some examples of how infrastructure debt financings are becoming more aggressive as additional capital has entered this space. Many new entrants do not have experience in the asset class and are investing because of recent trends and near-term investor demand, which may lead to exposure to more higher risk financings than desired.

Future growth opportunities

Which sectors could offer compelling new opportunities? In our view, two new areas of growth include the digital and cleantech sectors.

Digital

We believe we are in the early innings of the evolution of digital infrastructure. Many countries have set aggressive goals to build out modern fiber networks to ensure that minimum connection speeds are available for everyone (not just in high density areas) as the pandemic further emphasized how high-speed connectivity has become essential for business and everyday life. Other digital assets include cell towers and micro-towers, as communications companies look to optimize balance sheets and finance next-gen technology. The buildout of large-scale data centers is also expected to persist with the continued migration to the cloud coupled with the exponential growth in data consumption.

Cleantech

Sustainable investing initiatives can also provide a tailwind. While this initiative includes development of more solar and wind farms, it also impacts other sectors such as transportation assets (like rail and ferries) as owners look to upgrade their fleets to meet ambitious emissions reduction targets. We expect to see opportunities for the build-out of EV charging infrastructure along national highway systems as electric vehicles enter the mainstream. We also see further opportunities in LNG as developing countries transition away from fuel sources like coal.

Unless otherwise stated, all figures and estimates provided have been sourced internally. Data points have been calculated internally based on external market data sourced from Private Placement Monitor. All data, figures and commentary are as of September 30, 2023, unless otherwise noted.

Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

The information may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. This material contains opinions of the author, but not necessarily those of SLC Management, its additional investment teams or its affiliates.

Past performance is not indicative of future results. There is no guarantee that historical investment activity, approaches or volumes referenced herein will continue into the future.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

* For more information about the LEED rating system, visit www.usgbc.org/leed.

© 2023, SLC Management

SLC-20231030-3188297