Price inflation, fueled by supply chain delays and bottlenecks, and rising energy prices, driven by sub-optimal production levels, challenged the global economy throughout 2021. Inflationary concerns then reached a crescendo in 2022, leaving the Federal Open Market Committee (FOMC) in a difficult predicament. Ultimately, the FOMC shifted its dual mandate to focus solely on fighting inflation. The Federal Reserve’s hawkish pivot acknowledged the need to cool the overheated jobs market and the demand side of the economy. The convergence of elevated inflation data, the Fed’s aggressive rate hikes and increasing signs the economic outlook is deteriorating has left market participants increasingly pricing in a recession. These events create headwinds for public equity markets and other assets that are particularly sensitive to the economic cycle.

Finding opportunities in a high inflation environment

Investors should note that we are in an atypical economic environment. Historically, periods of rising real rates are often associated with improving economic conditions. However, the current environment is being driven by monetary tightening targeted at curbing inflation and by external macro events. Despite this unique set of circumstance, exploring the past performance of asset classes in relation to changing inflation can still give us insights into how they might fare in the current environment.

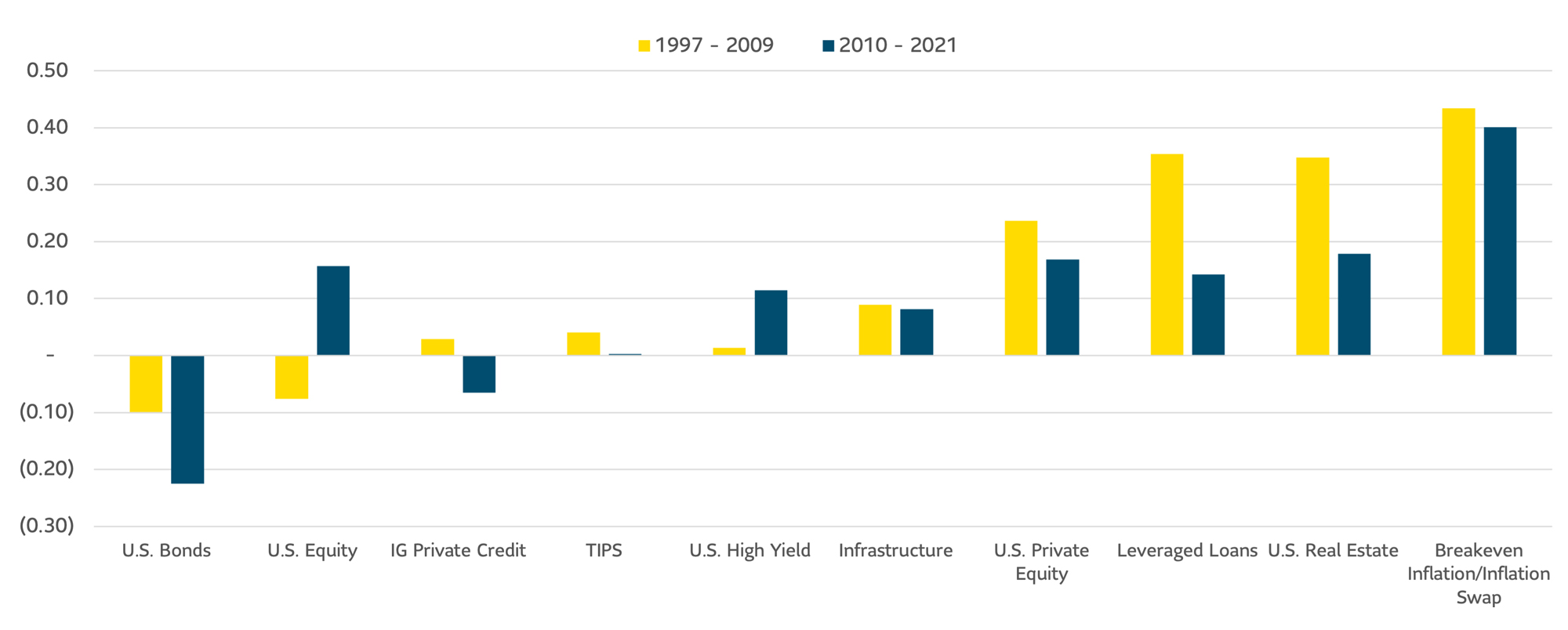

The following chart highlights the correlation between the returns of 10 major asset classes and changes in the Consumer Price Index (CPI). Higher numbers reflect more positive performance during periods of increasing inflation, and during the rising interest rates that typically accompany these periods. We look at two different time periods to highlight recent behavior as well as historical trends.

Chart 1 - Correlation between changes in CPI and the returns of various asset classes

Source: Historical returns from Bloomberg indices. A reading of 1.0 means perfectly positive correlation to inflation increases, and a reading of -1.0 means perfectly negative correlation to inflation increases.

Observations for various asset classes:

1. U.S. real estate

- The previous chart shows that returns on real estate exhibit a significant correlation to changes in CPI. This pattern is to be expected given the connection between increases in CPI and rising rents. The chart shows that this connection was stronger historically, but is still significant over the more recent period. Since certain property types do better than others in inflationary environments, portfolio positioning can be an important differentiator in today’s market environment, providing opportunities for a skilled manager.

- Higher inflation will generally benefit commercial real estate. Rents are rising and new construction will be tempered by material and labor costs. The strong labor market supports rising demand and rent growth.

- Office properties have been profoundly impacted by the pandemic and the shift to work-from-home. Opportunities in subtypes such as medical office and life science can insulate investors from challenges faced by the traditional office category. Other sectors include industrial warehouses and data centers, driven by booming e-commerce and continued tech growth.

2. TIPS and inflation swaps

- Treasury inflation-protected securities (TIPS) are fixed income securities in which both coupons and the repayment of principal increase and decrease with changes in CPI. This is a physical, liquid asset that provides a direct link between returns and inflation levels.

- Despite this connection, the previous chart shows that the correlation between changes in CPI and returns of the TIPS index is close to zero over both time periods. This is because TIPS also have a strongly negative correlation to changes in real rates due to their interest rate duration exposure.

- If the interest rate duration exposure of TIPS is being used as a hedge to liabilities, then returns due to changes in real rates are offset by returns on liabilities. The previous chart shows that after removing this exposure, the residual returns for TIPS due to changes in breakeven inflation are highly correlated to changes in CPI. These returns are expected to be similar to those that an investor would receive by investing in an inflation swap.

- Inflation swaps are liquid derivatives that provide returns from changes in breakeven inflation rates without sensitivity to changes in real rates, and can be paired with other physical cash flow generating assets to enhance a portfolio’s inflation protection. We will discuss some of the creative solutions that investment managers can implement for clients using inflation swaps in a later section.

3. Infrastructure

- Due to their long-term nature, the contracts for infrastructure assets typically include provisions for inflation-linked pricing that can protect investors from the effects of inflation. Assets can include facilities that provide essential services, such as utilities, and community infrastructure, such as schools and hospitals. These assets have low volatility and defensive characteristics, with stable cash flows typically adjusted for CPI growth.

“Demand-based assets such as toll roads or energy generation facilities can offer moderate inflation protection. Performance is linked to the asset’s usage—generally as the economy prospers, these assets are expected to enjoy higher revenues.”

4. Investment grade and below investment grade fixed income

- Returns on broader fixed income asset classes have varying correlations to changes in CPI. Shorter duration fixed income normally outperforms longer duration fixed income as valuations are less impacted by higher rates and investors have a shorter time horizon to reinvest at more favorable entry points.

- Floating rate debt, such as leveraged loans, have a positive correlation to changes in CPI as returns benefit from rising rates. While leveraged loans as an asset class are considered below investment grade, investors can also access floating rate debt in the investment grade space through allocations to floating rate corporate notes and securitized debt tied to LIBOR or SOFR, such as collateralized loan obligations.

- Fixed income with higher exposure to credit spreads, such as private credit and high yield bonds, have more varied sources of return. Often rising rates are accompanied by tightening credit spreads, dampening the effect of higher rates on overall returns, although this has not been the case in this rate-rising cycle. As a result, these asset classes have historically performed better during periods of rising inflation.