In this discussion, we’ll explore the defining features of NSC and why it can be a compelling investment for institutional investors seeking income (such as pensions, insurance companies and endowments) thanks to these potential benefits:

- The capacity for higher yields that can be sustained over time.

- Low correlations to traditional asset classes.

- Strategic small- to middle-market positioning, in a space with less deal competition.

- The ability to negotiate loan terms favorable to the investor.

Distinguishing between broadly and narrowly syndicated credit

Broadly syndicated credit is a form of financing provided by a group of lenders (the “syndicate” in the category’s name), which provides funds to a single borrower. This loan by definition is administered by a lead bank that is also one of the lenders.

Broadly syndicated credit presents numerous potential benefits for the investors as lenders, including pooling risk through the syndicate, providing investment exposure to the borrower without a heavier commitment of capital, the facilitation of a credible lead bank, a high degree of flexibility of loan structures (e.g., floating rates) and the opportunity to diversify fixed income allocations. Within the broadly syndicated credit category is NSC, a niche within the fixed income universe.

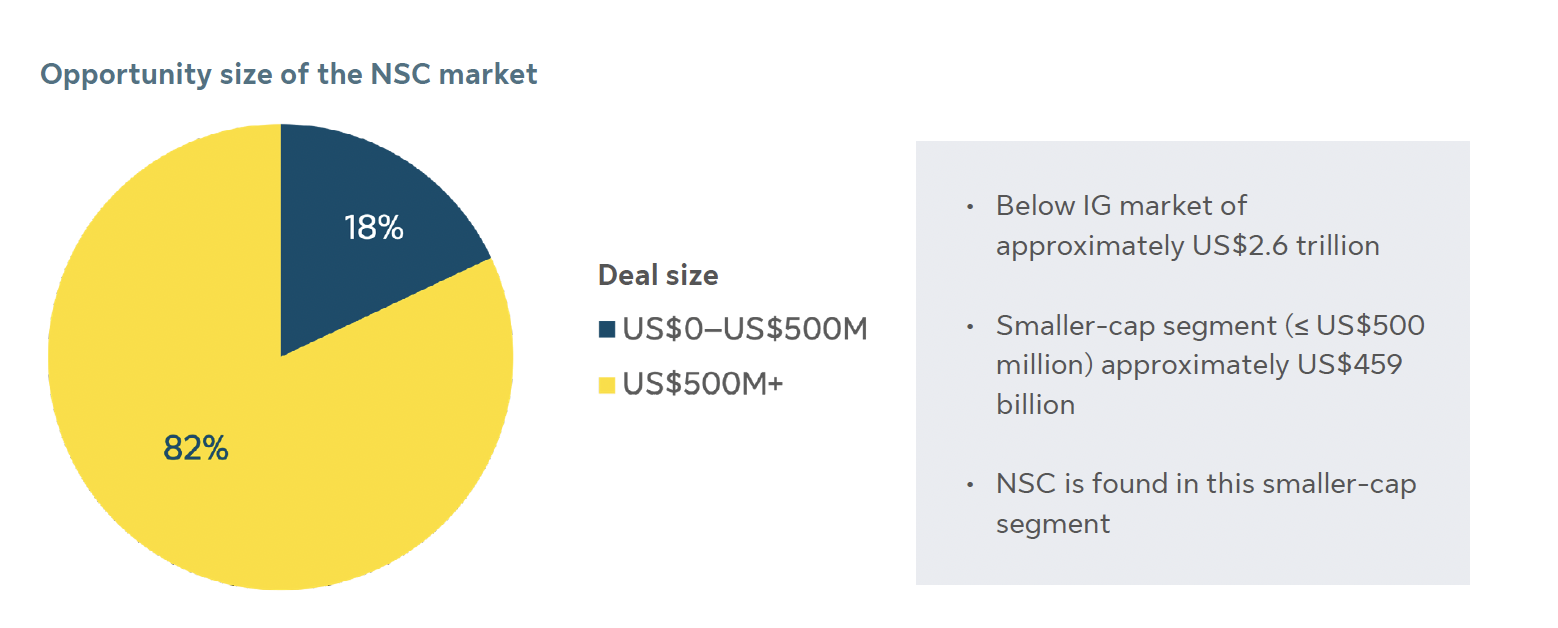

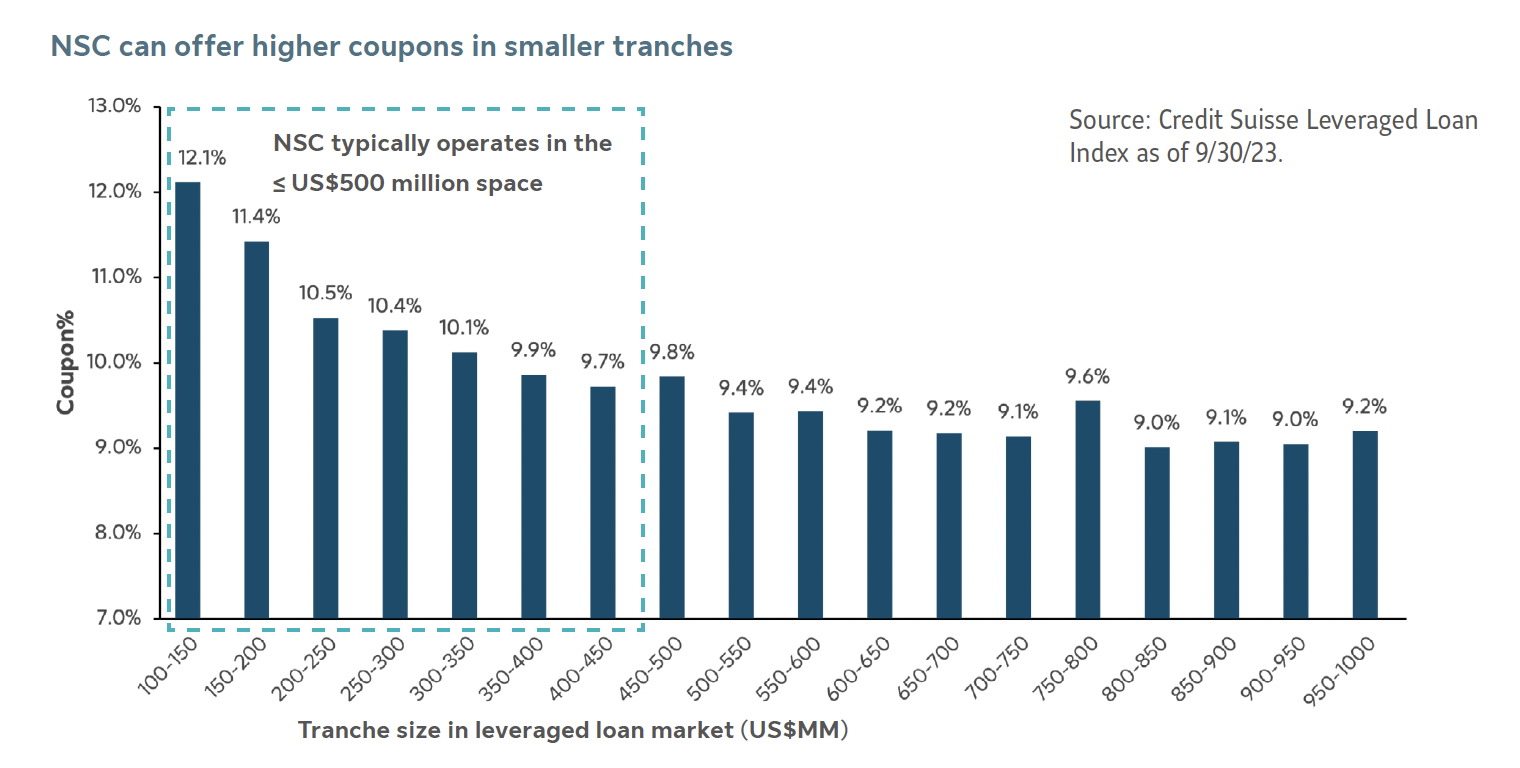

The definition of NSC can vary slightly from company to company, and may in fact change further over time due to market factors, but for practical purposes NSC can be defined as a subset of the high yield bond and bank loan markets consisting primarily of bonds and loans with a tranche size of less than US$500 million. The typical NSC borrower profile is a small- to mid-cap company, owned by private equity, that has graduated to syndicated lending and past the need for direct or privately originated loans, but would likely not be able to attract a high number of lenders.

Nationally recognized statistical ratings organizations (NRSROs) rate these debt instruments, and each syndicated credit arrangement has a fairly small pool of 5–10 lenders. As these assets are often more complex by nature (involving multiple lenders, detailed covenants, restrictions, etc.), they offer a yield premium to investors.

Source: Bloomberg as of 9/30/2023. Below IG corporate credit market size is determined using the market values for the ICE BAML US HY Index and Credit Suisse Leveraged Loan Index. For the ICE BAML US HY index, only securities that are 144A without registration rights and below US$500 million are included.

The benefits of NSC

While both broadly syndicated credit and NSC can be beneficial to investment portfolios, the NSC focus on small- to mid-capitalization companies seeking financing gives it distinguishing features that can be especially beneficial in certain market conditions.

The possible benefits largely stem from this smaller-capitalization focus. The profile of these debt instruments means they trade less frequently, and therefore have a lower liquidity profile than broadly syndicated credit. To compensate for this decreased liquidity, NSC offers higher yields and possibly other favorable terms for the lender.

These more targeted borrower segments are often overlooked by large lenders, and NSC itself has a limited buyer base due in part to its liquidity characteristics, which are not congruent with the daily-traded nature of many large asset managers, such as ETFs and mutual funds. This results in a supply/demand imbalance that tends to favor lenders, with higher coupons and smaller tranches from an under-explored market.

The more targeted buyer base also enables lenders to obtain additional benefits through favorable lending terms, such as investor-friendly covenants and structural enhancements, like floating rate characteristics.

The previously mentioned complexity of these credit agreements offers investors an additional premium as well. Furthermore, the typical NSC investor tends to have a more “buy-and-hold” focus, so NSC trading is less frequent and with lower price volatility as a result.

NSC represents an attractive niche market that has a sustainable yield premium over traditional liquid credit, but when compared to private credit offers greater liquidity and increased deployment pace. It is important to note, however, that the benefits of holding NSC can vary depending on an individual investor’s risk/return needs and investment mandate.

Is the NSC yield premium sustainable?

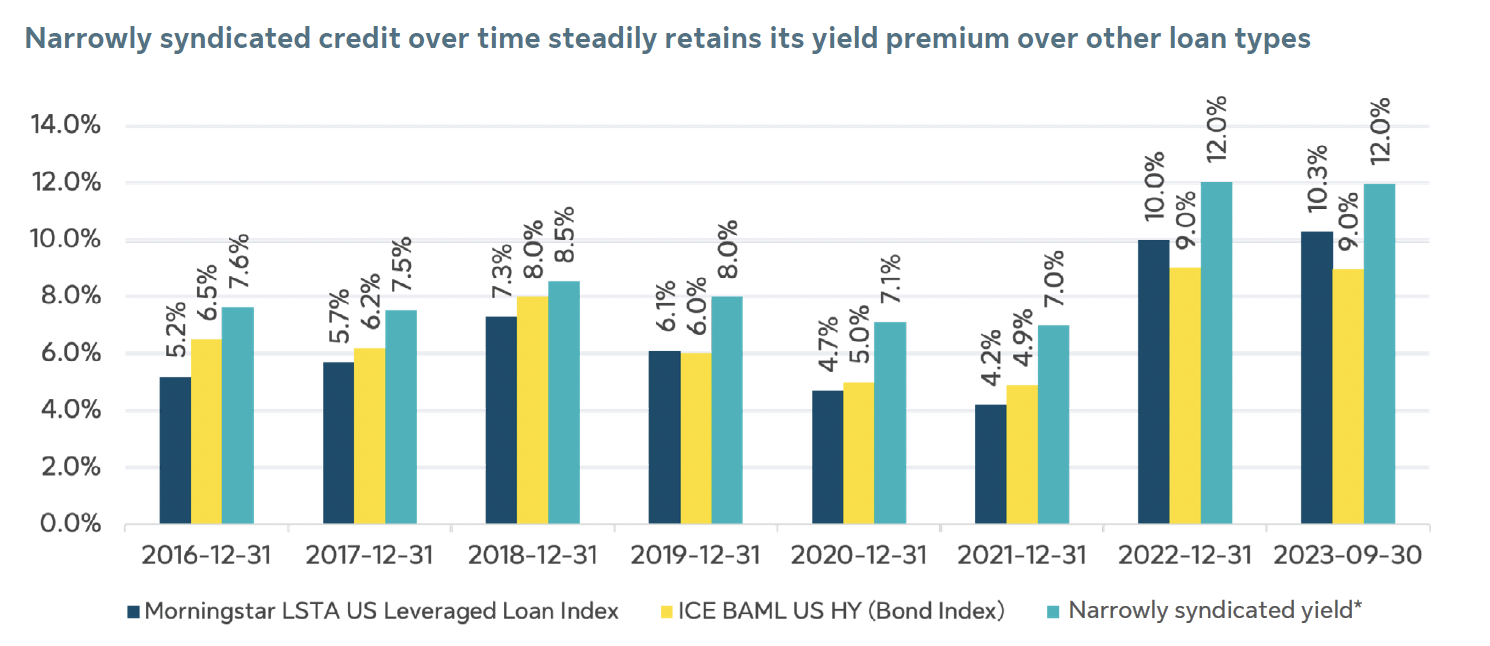

As the potential benefits of NSC largely stem from its status as a niche, underexplored market, it merits asking if these benefits are actually sustainable, or if they are vulnerable to a significant increase in investor interest.

It’s important to reiterate the defining features of NSC that tend to act effectively as barriers to entry for large asset managers. The liquidity requirements of large fund managers can exclude NSC from their investment mandates, which helps preserve the inherent advantage of NSC’s focus on small- to mid-cap credit.

Additionally, historical data illustrate the sustainability of NSC’s advantages over time. For nearly eight years, NSC has exhibited a notable yield premium over leveraged loans and high yield.

Source: Bloomberg, 2023, ICE BAML, Morningstar LSTA LL Index, JPMorgan, as of 9/30/2023. Narrowly syndicated credit information is based on combining 80% JPM Leveraged Loan Index US$300M tranche size or less and 20% JPM High Yield Bond Index US$500M tranche size or less.

Public and private credit indices shown are widely used market benchmarks to generally assess the relevant risk profile of a particular investment strategy. Future fluctuations in valuations and performance may occur as a result of changing market conditions, among other variables. The comparison indices and asset classes presented set forth herein are provided for informational purposes only and should not be relied upon as an indication of Crescent’s investment strategy or as an accurate measure of comparison, as there may be differences between the relevant Crescent funds and such indices due to varying fund vintages, strategies and inputs into the definition of NSC. The comparisons contained herein have inherent limitations and qualifications, such as limited sample size, imperfect access to information and other considerations. There are significant differences between the types of securities and assets typically acquired by a Crescent fund and the investments covered by the applicable index or benchmark. Certain indices may or may not reflect the reinvestment of dividends, interest or capital gains. Moreover, indices are unmanaged and are not subject to fees and expenses.

Comparing NSC to direct lending

NSC is often compared to broadly syndicated bank credit as well as privately originated debt, or direct lending, due to sharing certain characteristics with each universe alongside some key differences. Both NSC and direct lending can be valuable strategies for providing enhanced yield and diversification, but certain distinguishing characteristics of the former may benefit institutional investors seeking specific yield and liquidity characteristics. Such differences include:

- Structure and liquidity – Direct lending is usually offered through closed-ended funds, which are illiquid. NSC is open ended in structure and trades on secondary markets, offering a liquidity option for investors who seek it, though still with less liquidity than broadly syndicated credit and mainstream fixed income sources.

- Deployment time horizon – The origination process for direct lending involves private equity sponsors, investment banks or other private channels, and typically is structured as a closed-end drawdown fund deploying investor commitments for 3–4 years. As NSC is structured through the primary and secondary public market, full deployment of the portfolio can be achieved in 3–6 months.

- Pricing volatility – Direct lending funds typically value their private loans through quarterly internal “manager marks” and external annual audits. NSC utilizes third party pricing services and is often priced daily – and not less than monthly. As a result, NSC experiences more frequent marks and slightly higher pricing volatility compared with direct lending.

While both NSC and direct lending can add value to a portfolio through offering enhanced yields, the former’s distinct structural, liquidity and risk/return characteristics could offer specific benefits to an institutional portfolio, depending on the needs and objectives of the investor.

What NSC brings to a credit portfolio

With its distinctive set of features, structural characteristics and potential benefits to investors, NSC in many ways can be viewed as bridging the gap between high yield bonds, broadly syndicated credit and direct lending.

NSC can offer institutional portfolios:

- Enhanced yield – With traditional fixed income yields already at elevated levels, investors seeking income – such as pensions, insurance companies and endowments – can use NSC to enhance the risk/return profile of their portfolios.

- Credit diversification – NSC can serve as a source of higher yielding fixed income with low correlation to other fixed income sources.

- Income generation – When compared to other return-seeking asset classes, NSC provides a stable stream of cash flows that can be used to settle claims or benefit payments without requiring the sale of assets.

- Capital efficiency – NSC can provide a higher yield in exchange for a similar capital charge and risk profile as broadly syndicated credit.

It’s important to note that accessing NSC often requires the expertise to select the right securities based on factors such as management team strength, cash flow characteristics, issuer characteristics, industry profile and various security-level characteristics.

Active management may be key to unlocking these benefits, and partnering with an experienced investment manager could deliver a diligent security selection process and the potential to drive better performance through consistent yield premia relative to other asset classes.

About Crescent Capital

Crescent is a global credit investment manager with over US$40 billion of assets under management as of September 30, 2023. For over 30 years, the firm has focused on below investment grade credit through strategies that invest in marketable and privately originated debt securities including senior bank loans and high yield bonds, as well as private senior, unitranche and junior debt securities. Crescent is headquartered in Los Angeles with offices in New York, Boston, Chicago and London with more than 200 employees globally. Crescent is a part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life. For more information about Crescent, visit www.crescentcap.com.

Legal Information and Disclosures

This document expresses the views of the author as of the date indicated and such views are subject to change without notice. Neither the author nor Crescent Capital Group LP (“Crescent) has any duty or obligation to update the information contained herein. Further, Crescent makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Crescent makes this document available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Nor is the information intended to be nor should it be construed to be investment advice. Certain information contained herein concerning economic trends and performance may be based on or derived from information provided by independent third-party sources. The author and Crescent believe that the sources from which such information has been obtained are reliable; however, neither can guarantee the accuracy of such information nor have independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This document, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Crescent.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. These entities are also referred to as SLC Fixed Income and represent the investment grade public and private fixed income strategies in Canada and the U.S. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and, in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the US, securities are offered by Sun Life

Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”). Crescent Capital Group (Crescent) is also part of SLC Management. Crescent Capital Group is a global alternative credit investment manager registered with the U.S. Securities and Exchange Commission as an investment adviser. Crescent is a leading investor in mezzanine debt, middle market direct lending in the U.S. and Europe, high-yield bonds and broadly syndicated loans.

This material is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only.

The information is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained on this website. Nothing in this presentation should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

There is no guarantee that the portfolios described will achieve their target returns nor will be able to source the assets. Past performance is not necessarily indicative of future returns. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur. Performance is pre-distribution and gross of investment management fees (includes both capital appreciation and income), net of administration fees, and is calculated using the geometrically linked time weighted rates of return methodology to calculate the income returns and capital returns.

This material contains opinions of the author, but not necessarily those of SLC Management or its affiliates.

SLC-20231030-3052852