Market

After a busy first half of 2022, estimated third quarter issuance in the IGPC market was weaker this year than in the same period for each of the prior three years as the rise in interest rates began to dampen deal activity. Despite nearly every broker stating the post-Labor Day pipeline was robust, the 78-basis-point increase in the 10-year Treasury rate between August 1 and September 6 led issuers to reassess funding plans. We have seen several deals pulled from the market, typically for reasons of volatility. September, traditionally a robust month, was particularly weak as volatility drove the 10-year Treasury to over 4.00% at some points, up from 2.35% in April, with yields increasing over 30 basis points in one day. If issuers do need capital now, for acquisitions or capital expenditures, they seem to prefer shorter-term, floating rate bank deals instead of longer-term, fixed rate issues. To put this in context, September 2021 had roughly $7.5 billion of market volume for investment grade private placements. In comparison, reported volume for September of 2022 was $2.5 billion. While reported volume for the six months ending June 30, 2022, was almost 20% ahead of the same period last year, market volume was approximately 4% lower for the nine months ending September 30, highlighting the dramatic drop in issuance over the third quarter. In fact, volume for every month of Q3 2022 was weaker than the prior period in 2021 and 2020.

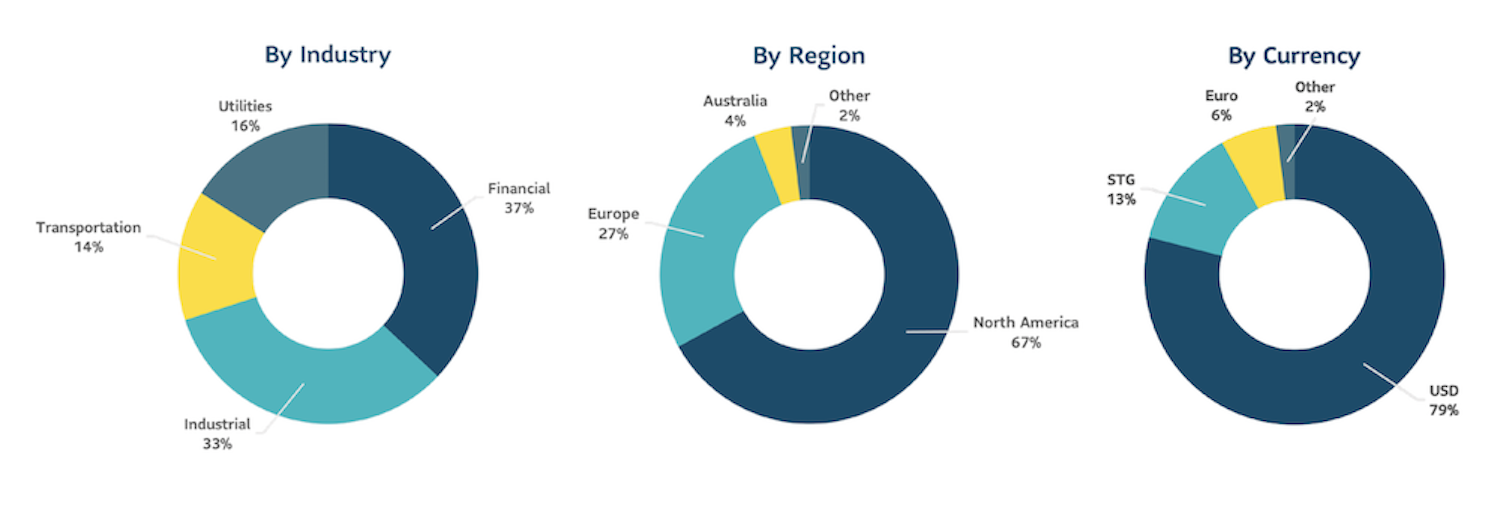

Financials (asset managers and REITs) have been strong issuers all year and continue to anchor volume. Financials have represented 45% of market volume for the year, slightly ahead of last year which was itself a record. Strong financial issuance drove short- to mid-term tenors in 2022 as the financial sector tends to issue mostly bullet structures of up to 10 years. Higher coupons contributed to lower longer-term issuance as borrowers prefer not to lock in today’s long-term rates. While the average deal size is slightly up this year versus last year, the number of deals is down by 10% and we have had far fewer deals of $1 billion or larger this year (four this year versus 14 last year) as issuers continue to take just what they need in this market. We have seen a pickup in cross-border and corporate issuance since the spring, especially in Europe and the U.K., as public bond markets in those regions have faltered and issuers have looked to the U.S. investment grade private credit market. Many of these issuers are good credits in non-cyclical industries, and we plan to take advantage of such opportunities if our relative value hurdles can be met.

Private spreads widened in September for BBBs and tightened somewhat for stronger credits as market volatility resulted in investors looking for more quality, or risk premium, for weaker credits. The market has appeared to be more rational lately, with some aggressively structured deals struggling to close.

Outlook

Our pipeline includes some interesting opportunities, ranging from a large-scale European utility to a cross border aviation transaction, as well as other more unique club or bilateral deals. As we enter October, it is hard to predict the level of activity for the balance of the year given all the economic and geopolitical headwinds. We are hearing from brokers that some investors are already looking ahead to 2023. However, we remain focused on our strategy of rigorous underwriting and disciplined pricing. We remain opportunistic, as we believe that there will be good deals with solid credits and strong relative value before the year wraps up.

Q3 2022 |

Weighted average life |

Average rating |

Average Spread1 |

|---|---|---|---|

Private Placement Monitor |

11.5 years |

32%: A 68%: BBB |

234 basis points |

1 All commitments.

In focus: Private credit opportunities in professional sport

With the NFL season now back in full swing, the World Series upon us and the NBA and NHL kicking off their 2022–2023 seasons, October is often considered the most exciting month of the year for American professional sports. However, in addition to their entertainment value, pro sports can also provide a unique set of IGPC opportunities. The characteristic benefits of private credit – such as bespoke financing terms and confidentiality – can attract professional sport leagues and franchises as investment-grade issuers, representing multi-billion-dollar industries with globally recognized brands and multiple revenue streams. In this space, the types of deals for investors in investment grade private credit commonly fall into two categories: 1) league financing, and 2) sports infrastructure.

League financing

In the league-wide financing space, major sports leagues have long been regularly tapping IGPC markets to issue debt to cover liabilities, provide working capital and fund operations. These issuances are typically backed by league media and broadcasting contracts. The importance of these broadcasting contracts backing up the debt issuance of pro sports leagues is significant, as the arrangement underpins the investment grade and long-duration profile of these investments.

The value of these contracts, plus their multi-year nature, give investors the benefit of long-term and contractually mandated cash flows from a highly rated counterparty. The growing viewership numbers behind many major league sports has also led to substantial growth in these broadcasting contracts. For example, the NFL’s most recent package of broadcasting contracts was for 11-year terms worth over $110 billion in total, almost doubling that of the previous package of contracts. Similarly, in the NHL, the league’s last package of U.S. broadcasting contracts, for seven years at $625 million per year, more than doubled the value of its last U.S. contracts.

Sports infrastructure

The second major source of opportunity for IGPC in pro sports is in infrastructure, usually the funding the construction of stadiums and arenas. Over the last 20 years, there has been a notably high turnover in North American sports infrastructure. Legacy event facilities, while still functional, have been driven closer to obsolescence in a competitive economic environment in which the maximization of revenue, through sponsorships, luxury seating sales and other business operations, has become paramount. The need for financing to replace aging pro sports infrastructure has resulted in considerable activity in the IGPC market.

For the IGPC investor, major benefits from such financing include multiple sources of contracted revenue backing these issuances, coupled with strong support from the sponsor. With the underpinning of these cash flows and deals based on the amortization of physical assets with a long lifespan, private credit issuances in sports infrastructure tend to have long durations and investment grade ratings.

SLC Management’s IGPC positioning in pro sports

As a long-term and established investor in debt issues of both professional sports leagues and sports-based infrastructure, we see many opportunities in the space. However, we remain highly selective in our investments, as this market, like all others, has become crowded and deal pricing is emerging as a concern. We continue to monitor this sector closely and expect to see future opportunities across all of the major sports leagues, but in particular Major League Soccer, which has reported substantial growth and exhibits considerable potential for further expansion.

When looking further into the below 10-year segment of the market, we note that the while the growth was spread across all tenors the biggest growth was seen in the 7–10-year term bucket and <5 years. Driving this growth was the dominance of issuance from investment managers, financials and REITs. The financial sector (investment firms, asset managers, REITs and real estate) represented 66% of market issuance for Q1 and represented 51% of total issuance for H1 2022. REITs have historically been an important issuer in this market, but the wave of investment firms and asset managers that began during the onset of the pandemic has accelerated in 2022.

Though the IGPC market has been historically focused on longer-term investment opportunities, it found itself in the surprising position of having an ample supply of short-term opportunities, perhaps even exceeding demand.

SLC-20221025-2551754

Data presented in this article has been calculated internally based on external market data sourced from Private Placement Monitor.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc.(“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of June 30,2022. Unless otherwise noted, all references to “$” are in U.S. dollars.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management