Over the past twenty years we have seen several evolutions in the way pension plan sponsors have approached the liability-driven investing (LDI) space. Changes to accounting practices initially led sponsors to take a more mark-to-market approach, and later the adoption of glidepaths set many on a one-way journey to de-risking their plans.

The typical glidepath dictates an allocation between growth-oriented assets (like equities) and liability hedging assets (traditionally investment grade fixed income). While a great tool for maintaining de-risking discipline and ensuring the plan continues towards its longer-term goals, we believe this approach has at times led to beneficial asset classes being overlooked by investors because they don’t fit neatly in the black and white world of “growth versus hedging.”

However, in the last few years as more plans have matured and moved down their glidepaths, we have seen a surge of interest in asset classes that fall in the grey areas between the growth and hedging buckets. These asset classes often come with higher return expectations, additional diversification benefits and varying degrees of liability hedging attributes. In this article, we look at some of these “liability friendly alternatives” and the way plan sponsors are using them in their portfolios to improve long-term outcomes.

What makes a hedging asset a hedging asset?

When viewing the liability hedging bucket through a narrow lens, the traditional approach has often been to utilize only the asset classes that most closely mirror the overall sensitivities (interest rate, credit spread and otherwise) of the liabilities. Given most discount rates are based on high quality corporate bond yields, for the typical pension plan this portion of the assets was predominantly made up of long-duration treasuries and investment-grade corporate bonds. However, used alone, these asset classes are not always able to meet a plan sponsor’s return or diversification objectives. This stands in contrast to the growth bucket, which has become more diversified over time, utilizing allocations to alternative asset classes.

We believe that plan sponsors can benefit by expanding the toolkit to include other asset classes that share some risk exposures in line with the liabilities, namely to duration and/or to credit spreads to different degrees. Where each asset falls on the growth versus hedging scale will differ based on the nature of the underlying investments and the approach of the asset manager.

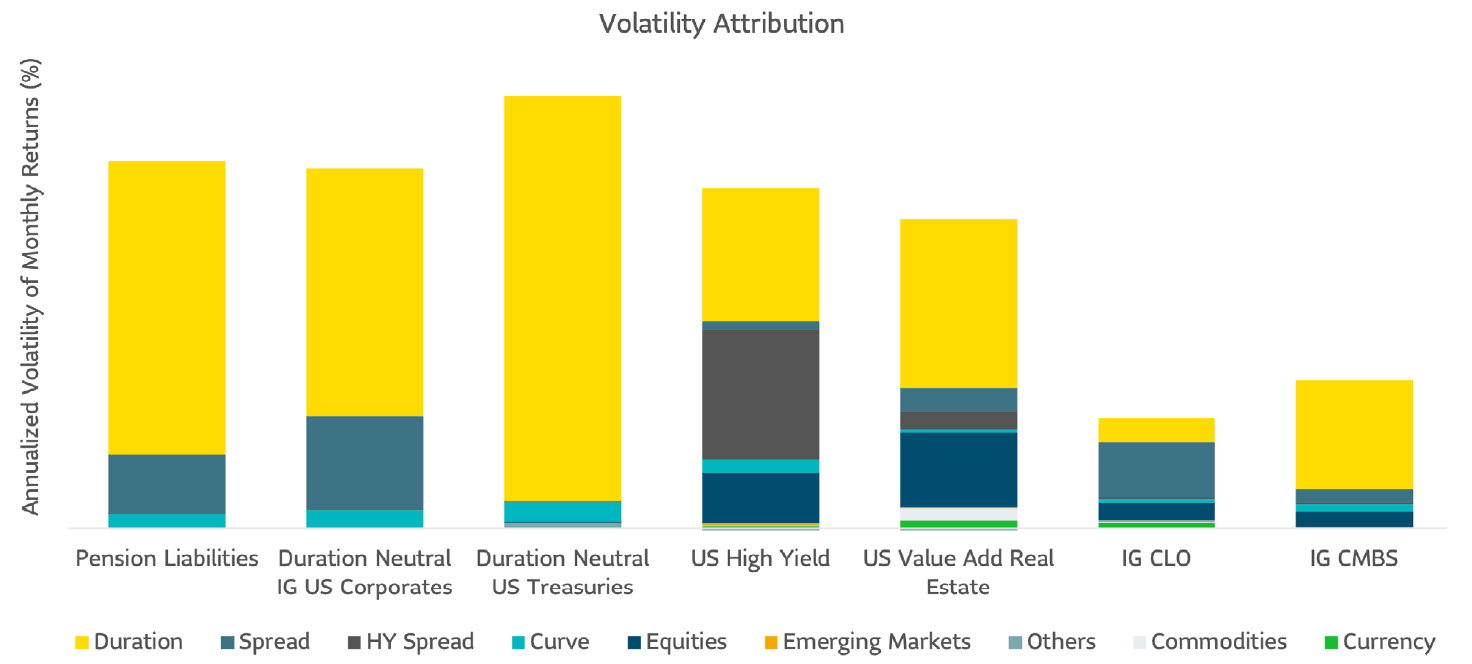

Pension liabilities are highly sensitive to movements in rates and credit spreads

(1) Pension Liability duration and historical returns based on the FTSE Pension Liability Index – Short

(2) Duration Neutral IG US Corporates represents a duration neutral blend to the pension liabilities of the Bloomberg Long Corporate Index and the Bloomberg Intermediate Corporate Index. Duration Neutral US Treasuries represents a duration neutral blend to the pension liabilities of the Bloomberg Long Treasury Index and Bloomberg Intermediate Treasury Index.

(3) US High Yield, US Value Add Real Estate, IG CLO, and IG CMBS represent the Bloomberg US High Yield Index, sample US Value Add Real Estate Debt strategy, JPM CLOIE IG Index, and the Bloomberg US CMBS Index, respectively.

An evolution not a revolution

Pension plan liabilities are essentially “immune” to downgrades or defaults in the discount rate used to value them. This presents challenges for plan sponsors looking to construct fixed income portfolios that can keep pace and maintain funded status. Typically, plan sponsors have looked down the quality spectrum to increase potential returns and add diversification as they seek to build robust hedging portfolios. However, there are other asset classes that can help provide additional yield without sacrificing quality.

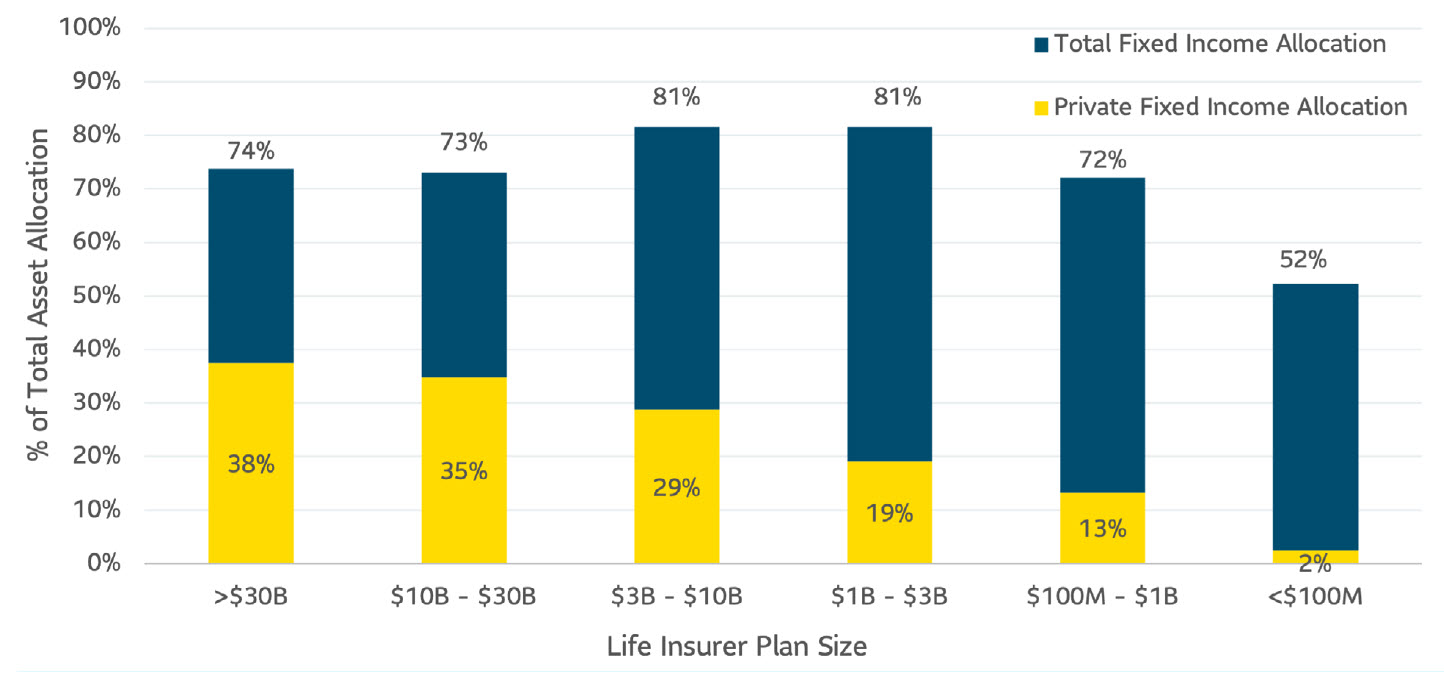

"For most plan sponsors the majority of their assets are always likely to remain in more traditional asset classes. However, the introduction of even a small allocation to alternatives can lead to significant improvements in expected returns while still maintaining a strong correlation to plan liabilities. Insurance companies have long utilized alternatives to back long-term liabilities, and this has been a major contributing factor to the attractive rates available for pension risk transfer pricing. We have seen a similar evolution in LDI portfolios, as plan sponsors have adopted similar practices"

Life insurers have long utilized private assets to provide attractive annuity pricing

(1) Based on NAIC Statutory Filing as of 12/31/2020 from S&P Global

Expanding the toolkit

Below are a few of the more common asset classes we see utilized in this space. The spectrum of assets that fall between the growth and hedging buckets varies significantly in terms of their attributes. Some of these assets closely mirror the risk exposures of the liabilities while others only hedge limited aspects

Asset Type |

Contribution to “Growth” |

Contribution to “Hedging” |

|---|---|---|

Treasury/Government Bonds |

Weak - typically under-yields the liability discount rate. |

Strong – provide a duration hedge, ultra-long STRIPS or levered vehicles often first choice to improve hedge ratio. Does not help with hedging credit exposure in the discount rate. |

Investment Grade Corporate Bonds |

Moderate – even though discount rates are derived from AA-corporate bonds, the discount rate is immune to downgrades so the portfolio must “outperform” just to keep pace. Managers can do this by going down in quality or through active management. |

Excellent – can provide similar duration and credit exposure to the liabilities. Need to be conscious of quality differences between portfolio and discount rate methodology. Not able to extend duration as much as treasury portfolios. |

Securitized Assets |

Good – typically outperforms equivalent corporates, especially in shorter durations. |

Good – longer duration securitized can contribute to liability hedging, shorter duration securitized can provide strong cashflow matching opportunities and credit spread hedging for cash balance plans. |

Investment Grade Private Credit |

Good – can provide strong relative value compared to equivalent public corporates across the yield curve. |

Good – can provide duration and spread, correlates well to discount rates over longer time periods, some shorter-term tracking error reflecting changes in liquidity premium in the market. |

Real Assets – Real Estate/Infrastructure |

Strong – expected returns often higher and more diversified compared to traditional equities, can also provide inflation protection. |

Mixed – may provide a high level of regular long-term income that can be used to meet benefit payments however exhibit lower correlation to traditional discount rates. |

High Yield/Bank Loans |

Strong – can consistently outperform IG credit, yield advantage typically more than compensates for potential losses. |

Mixed – short duration/floating nature means limited hedging properties, however can be very beneficial for hedging credit spreads in cash balance plans and front end cashflows given significant yield advantage. |

Securitized assets

For long duration liability-focused investors, both long duration commercial mortgage-backed securities (CMBS) and collateralized mortgage obligations (CMO’s) can serve as diversified sources of credit exposure that are correlated to typical liability discount rates. One of the unique features of most CMBS bonds are prepayment penalties to the borrower that create a more stable cash flow profile and defined duration compared to other securitized sectors.

CMO’s are another attractive tool for liability hedgers due to their bulleted duration characteristics. Unlike traditional MBS, which tend to have fluctuating duration and unpredictable cash flows, sequential pay CMO’s are designed in a way that shield lenders from borrower prepayment resulting in more stable income streams.

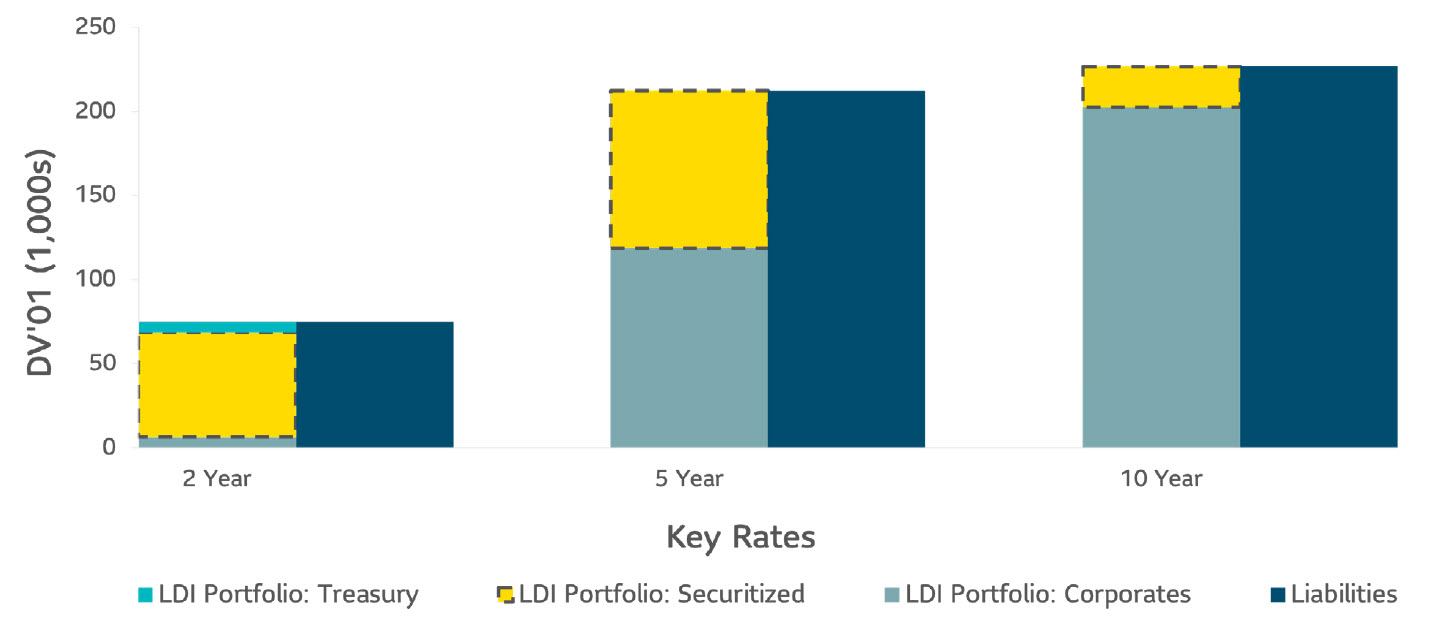

Shorter-duration securitized assets can also be used to hedge liabilities, especially for plan sponsors focused on meeting front-end cashflows. Asset backed securities (ABS), CMBS, and collateralized loan obligations (CLO’s) can all be valuable tools and typically have a noticeable yield advantage compared to the equivalent duration corporate bonds used to discount the liability cash flows.

Shorter-duration securitized assets can be used to hedge liabilities, especially for front-end cashflows

(1) Data from Bloomberg PORT/PREP

(2) The portfolio presented herein is not actual, does not reflect the portfolio of any client’s account nor is it a prediction, projection or guarantee of future performance. It is for illustrative purposes only. The above should not be relied upon and does not constitute a specific offer to buy and/or sell securities or investment services.

“A typical problem faced by plan sponsors when using securitized assets within an LDI solution is finding an appropriate securitized benchmark. Often publicly available benchmarks have durations that move significantly over time. For this reason, our preferred approach is typically to give portfolio managers the freedom to make out-of-benchmark allocations to securitized sectors within traditional credit mandates. This allows the manager to make relative value decisions in real-time between corporate and securitized sectors, as well as ensuring that they manage the duration cognizant of the broader LDI goals”

Investment Grade Private Credit (IGPC)

As plan sponsors look for ways to add diversification and additional yield to their portfolios without taking on excess credit risk, investment grade private credit has become an attractive option. Insurers have historically accessed this asset class to back long-term liabilities, and we believe a similar opportunity exists for plan sponsors to earn extra yield while still maintaining a strong correlation to plan liabilities.

Investment grade private credit is an attractive asset class for plan sponsors looking to hedge high-quality liability discount rates. The correlation between IGPC yields and AA-rated corporate bond yields reflects the high-quality nature of the asset class and the joint dependence on underlying treasury yields. Typically, IGPC yields provide greater stability in more volatile environments as they react more slowly to changes in the market.

When investing in private assets, it’s important for plan sponsors to have a good understanding of their long-term needs for the plan assets, whether it be paying benefit payments indefinitely or purchasing an annuity. In both cases, we believe that most plan sponsors underutilize privates.

“For plans looking to diversify their fixed income portfolios, IGPC makes a ton of sense as a first step. We typically look for about 70-100bps in excess yield versus the equivalent public bond and have lower default and higher recovery rates. We’re really getting paid for the extra work here rather than for taking on extra risk versus the liabilities”

Investment grade credit ratings of our private placement’s portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

Real estate and Infrastructure

Both real estate and infrastructure investments (debt and equity) typically provide yields in excess of those available in traditional asset classes. Over short time periods the correlations between these less-liquid asset classes and the more mark-to-market liabilities can be lower. However, the long-term nature of these investments combined with the stable yields available through careful manager selection can align well with the cashflows of a defined benefit pension plan.

Similar to IGPC, it’s important for plan sponsors to understand their liquidity needs and ensure they have a liquidity plan at the total liability hedging portfolio level. This is particularly important for real estate and infrastructure, as investments in each of these asset classes can have quite specific redemption and lockout rules. For plan’s that still have ongoing accruals, or those with a Cost of Living Adjustment (COLA) included in the benefit structure, these asset classes can also provide protection in times of increased inflation.

“Real estate debt has many of the properties of both real estate and fixed income. If you look at how the typical large life insurer has invested, the average allocation to real estate has been around 15%. As more plans reach the hibernation stage and look to “self-insure” we expect to see an increased uptake in the strategy from plan sponsors looking to take advantage of the consistent yields and long-term cashflows”

High yield bonds and bank loans

On the growth end of the spectrum, we are increasingly seeing investors getting comfortable holding lower-rated fixed income instruments to back liability cashflows. On a mark-to-market basis, this may introduce some basis risk versus the higher-quality liabilities. As such, we often see this asset class utilized in a more buy-and-hold approach to hedge shorter duration cashflows

While high yield bonds can provide regular income to meet benefit payments, bank loans are largely floating rate, providing some protection in a period of rising rates. For cash balance plans that are exhibiting shorter durations due to the interaction of the discount rate and interest crediting rate, this is an attractive option for helping to meet the annual increase.

“High yield fixed income has historically been less volatile than equity and has not experienced nearly the same degree of drawdowns. One of the advantages of high yield fixed income is that it continues to produce income in the form of coupon and principal repayments, even at times when values have been depressed due to a market downturn.”

Liability friendly alternatives are becoming easier to access

Previously, some of these strategies may have been more difficult for plan sponsors to access. For example, IGPC has historically been the exclusive domain of larger life insurers. However, with commingled vehicles now widely available across real estate, infrastructure, and private credit, accessing these strategies has become easier and more cost effective. Many can be accessed via vehicles that help provide both flexibility in sizing and exposure to certain sectors that weren’t previously available to smaller plans in separate accounts.

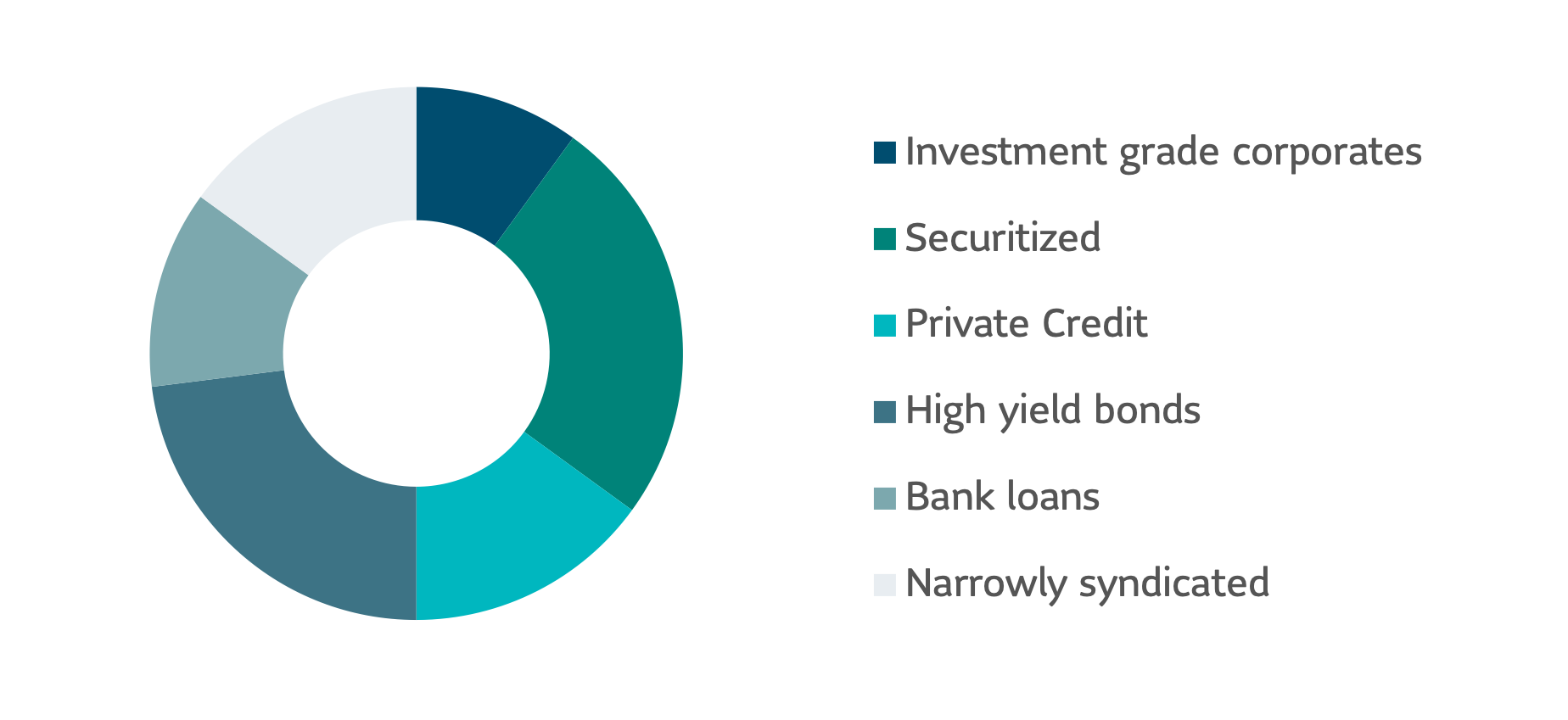

Another evolution that has made it easier for plan sponsors to add broader fixed income exposure is the development of Multi-Asset Credit (MAC) strategies. These strategies provide access to multiple fixed income strategies in a single vehicle and at a lower minimum investment. They also provide investment managers an opportunity to add value by actively managing the allocation to each asset class.

“Our MAC strategy is designed to allow specialized teams the freedom to manage their individual sleeves, while at the strategy level we position the allocations to each sleeve to reflect where we are seeing the most attractive opportunities. We believe the combination of public and private assets is pretty unique and provides a diversified source of credit exposure for plan sponsors.”

Sample Multi-Asset Credit (MAC) strategy target allocation

Summary

As liability hedging has become a bigger part of DB asset allocations, we increasingly see plan sponsors looking to diversify their portfolios. With funded status improvements also leading to higher demand for pension risk transfer strategies and potentially higher costs, many are opting to create self-sufficient hedging strategies instead.

Traditionally, sponsors faced the difficult choice between growth versus hedging assets, where enhancing return, yield and diversification meant removing the focus from the liabilities. We believe by exploring liability friendly alternatives, sponsors can find strategies to improve these metrics, while still meeting their hedging goals.

At SLC Management we work alongside our clients and consultant partners to deliver LDI solutions, utilizing a broad array of traditional and alternative asset classes managed by a group of specialty managers, SLC Fixed Income, BentallGreenOak, InfraRed and Crescent Capital. We believe in taking a holistic approach to liability driven investing that helps plan sponsors understand the risks inherent in their assets and liabilities and to invest in line with their long-term goals.

SLC-20221017-2461724

Disclosures:

Nothing in this presentation constitutes an offer to sell or the solicitation of an offer to buy securities. The information in these materials is provided solely as reference material with respect to the Firm, its people and advisory services business, as an asset management company. Any offer to sell or solicitation of an offer to buy a security may only be made by a separate private placement memorandum with respect to that security.

Sun Life Institutional footnotes and endnotes contain important information about the definition of terms used herein, the composition of the portfolios presented and related performance information as well as unrealized investment valuations and should be carefully reviewed. Market data and information included herein is based on various published and unpublished sources considered to be reliable but has not been independently verified and there is no guarantee of its accuracy or completeness.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association.

Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of December 31, 2021. Unless otherwise noted, all references to “$” are in U.S. dollars.

Past performance is not indicative of future results.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management