Nitin Chhabra, FCAS

Managing Director, Head of Insurance Client Relationships and Solutions

SLC Management

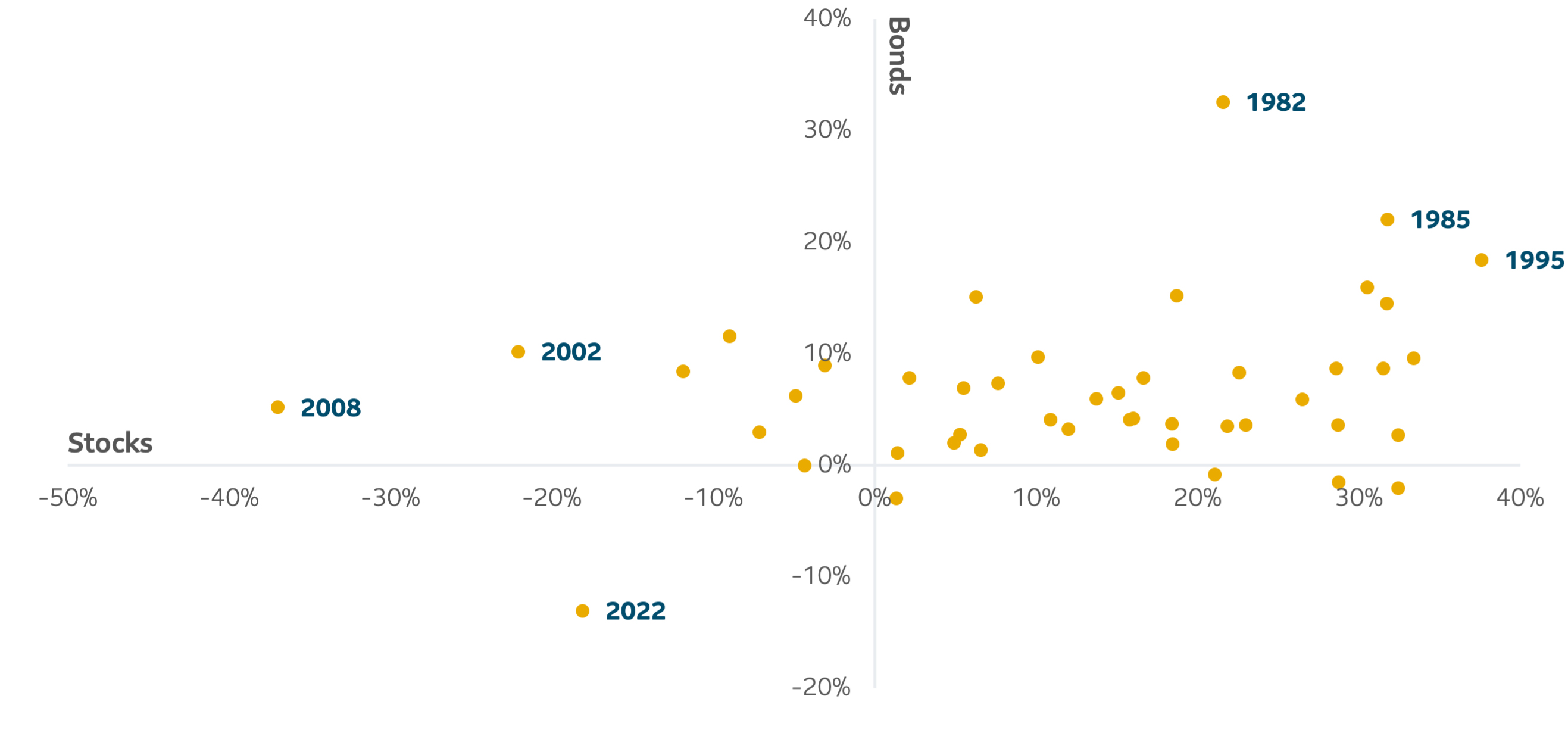

In 2022, the U.S. Federal Reserve increased rates to painfully restrictive levels in an attempt to tame inflation. This led to the worst ever total return performance year recorded by the bond market since the formation of the Bloomberg Aggregate Index in 1977. It also marked the first time over this period that both stocks and bonds delivered negative returns in the same calendar year.

However, what we’ve learned over the years is that market dislocations lead to opportunities, and we believe current conditions are no different. The bond market selloff of 2022 has created a potential window for insurance investors to lock in attractive yields in both the traditional and alternative fixed income markets, which can benefit investment income for years to come.

2022: An outlier for negative total returns in bonds and stocks

Source: Bloomberg. Total returns for historical time periods 1977–2022. Bond performance measured by Bloomberg US Aggregate Bond Index; stock performance measured by S&P 500 Index. Assumes reinvestment of dividends.

For insurers, investment income drives earnings

While the 2022 bond market selloff hurt insurance companies’ unrealized gain/loss positions, the resulting higher reinvestment yields will benefit the amount of investment income they generate going forward. Most companies are happy with that tradeoff, and to understand why let’s step back and consider the importance of investment income to the insurance industry.

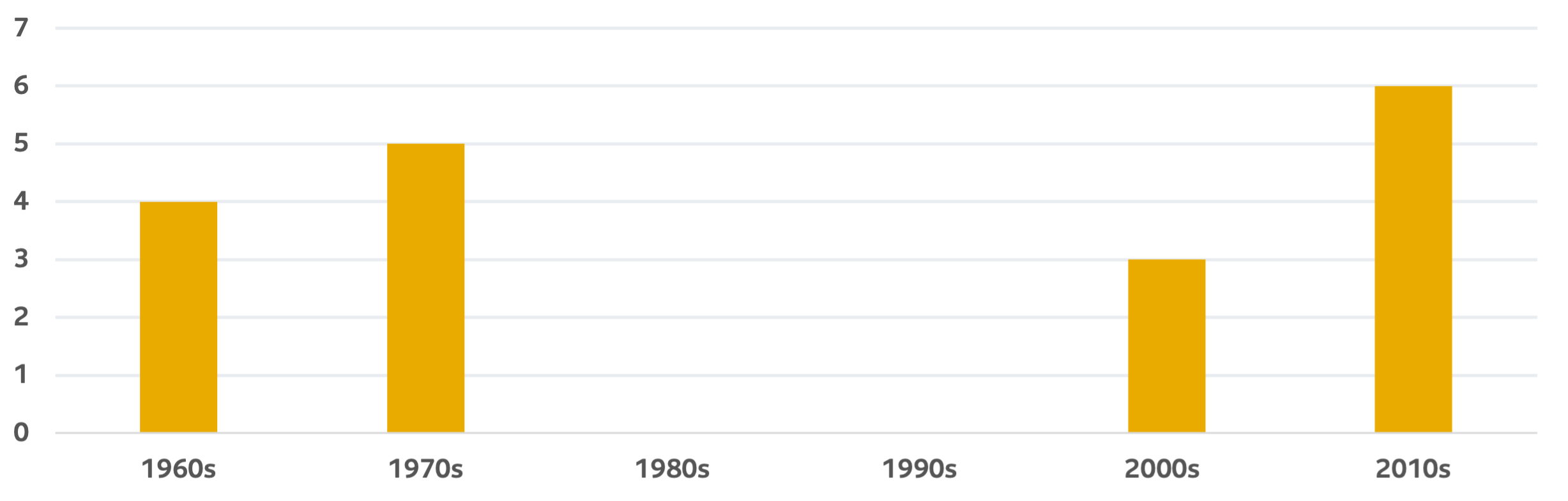

Insurers have two primary sources of income: underwriting income and investment income. If we look at the property & casualty insurance industry in any given year, more often than not the industry loses money on the underwriting side and makes money on the investment side. In fact, there was a 25-year period from 1979–2003 in which the industry in aggregate produced an underwriting loss in every single one of those years.

Underwriting profits in P&C insurance: A 25-year period of losses

Source: Insurance Information Institute. Data as of 12/31/2020.

For an industry whose primary objective is to collect more premiums than it pays out in losses and expenses, it failed to do so for 25 consecutive years. Now, insurers could afford to swallow underwriting losses because interest rates were much higher back then, so a lot of it was intentional, but it’s still a mind-boggling statistic to read. The point is this: investment income has been and will continue to be the driver of earnings, so insurers welcome the increase in investment income they will see going forward.

Near-term opportunities to lock in attractive yields

As investors, it is important to have a lens that includes both Treasury yields and credit spreads and how the two balance with each other. As of this writing, in 2023 we have seen spreads tighten (largely driven by a lack of supply) and Treasury yields decrease (on increased recessionary fears). However, we expect both to move higher in the near future. On spreads, we believe the technical forces that drove spread tightening year to date will subside and risk will be more appropriately priced in. On rates, our belief is that the Fed will need to raise rates to a level above inflation – and keep them there for some time – meaning a longer wait for any potential rate cuts.

That stated, at some point we believe spreads and rates will begin to diverge and move in opposite directions as recessionary risks escalate. At this point, spreads will likely continue to move higher while Treasury yields would fall as rate cut expectations increase. Our view is that there’s a near-term window for insurers to lock in attractive all-in yields that will benefit their portfolios for years to come, and the length of that opportunity depends on how soon you think the Fed will reverse course and cut rates. And because bonds being purchased today have much higher coupons than what we’ve seen over the past decade, that will help reduce the likelihood of negative total returns going forward since the higher coupon income will help offset price declines.

All-in market yields today (as represented by the Bloomberg U.S. Intermediate Aggregate Bond Index) stand at 4.5%, which is nearly three times the level they were at in the beginning of 2022, and reached as high as 5.1% in October 2022.

All-in yields considerably higher than at the beginning of 2022

Source: Bloomberg. Yield to worst of the Bloomberg U.S. Intermediate Aggregate Bond Index as of December 2022. Yield to worst is the lowest potential yield that can be received on a bond without the issuer actually defaulting. This metric is used to evaluate the worst-case scenario for yield to help investors manage risks and ensure that specific income requirements will still be met.

Taking advantage of the higher interest rate environment

The inflation that has driven the spike in bond yields has also resulted in higher insurance claim severity, which has been felt across all lines of business. Those higher claim amounts have directly impacted the ability of companies to reinvest in this market. Across our insurance client base, we’d bucket companies into four groups based on the degree to which they’ve been able to capitalize on the higher yields, in the following order:

- Haven’t been able to reinvest and were forced to sell bonds at a loss to cover claim payments

- Haven’t been able to reinvest but were able to cover claim costs using bond principal and interest payments, so they weren’t forced sellers

- Have been able to reinvest all cash flows and improve their average book yield

- Have been able to reinvest all cash flows and had the ability to harvest losses and reinvest those proceeds at higher yields

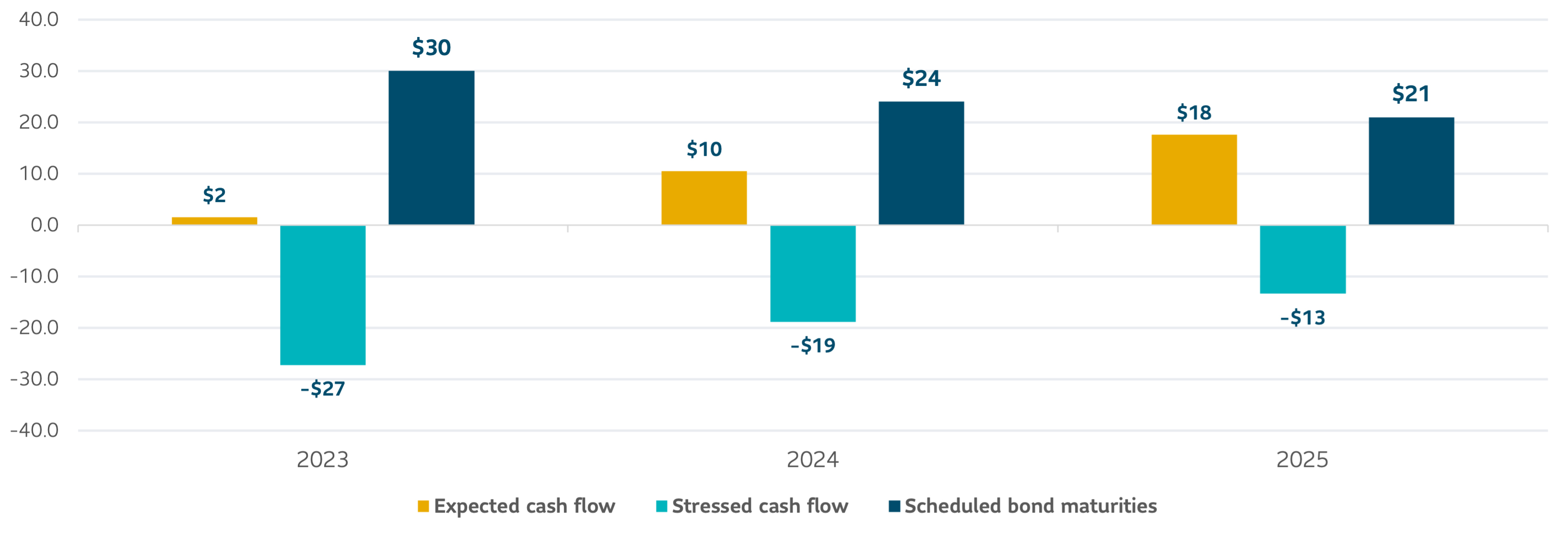

Fortunately, we’ve seen very few clients in that forced seller group, and that’s the function of working with those clients to ensure that their portfolio maturity structure is aligned with their liabilities in a way to provide a consistent amount of cash flow each year to cover higher than expected claims activity. This type of exercise is an important part of assessing how much duration risk a company can take.

Stochastic illustrative cash flow analysis to ensure bond maturities cover higher-than-expected claims

Source: Illustration based on a stochastic SLC Management financial model with varying underwriting and investment assumptions. Stressed cash flow is produced by running simulation and selecting the 90th percentile worst outcome. No undue reliance should be place on this information.

Alternative investments continue to be a focus of client conversations

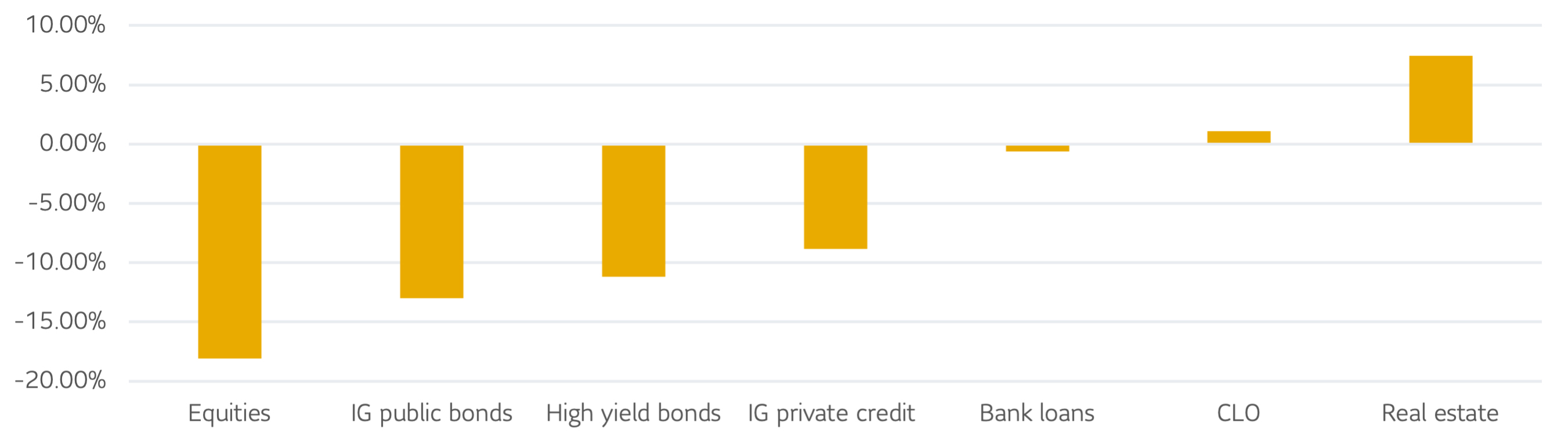

Prior to the recent spikes in rates, alternative asset classes such as private credit, real estate and infrastructure were generating increased interest from insurance company investors in their search for yield given what the market was compensating investors for when buying traditional fixed income securities. While we believe yields in core fixed income are now much more attractive, these alternative asset classes continue to offer additional spread and enhanced expected returns.

Insurance companies are getting increasingly more comfortable with the perceived risk and complexity associated with these investments. An important part of this evolution is utilizing strategic asset allocation analysis to better understand the impact on expected overall risk/return from adding alternatives to a portfolio, including their diversification benefits and downside protection features that help during recessionary periods. Looking at asset class returns in 2022, the lack of correlation to traditional insurance investments played out to the benefit of more diversified portfolios.

Alternative investments offered non-correlated returns in 2022

Source: Bloomberg, 2022. Total returns based on the following indexes: S&P 500 Index (equities), Bloomberg Aggregate Bond Index (investment grade [IG] public bonds), ICE BofA US High Yield Index (high yield bonds), Stonecastle Intermediate Investment Returns (IG private credit), Morningstar LSTA US Leveraged Loan Index (bank loans), J.P. Morgan Collateralized Loan Obligation Index (collateralized loan obligations [CLOs]) and Open End Diversified Core Equity (ODCE) Index (real estate).

Based on conversations with clients and prospects, we believe we are in the early innings in the trend toward increasing allocations to alternative asset classes.

Increasing regulatory scrutiny

The push into non-traditional investments has continued unabated despite likely changes in the capital treatment and reporting of these investments in insurance company portfolios. Over the years, product innovation has resulted in the creation of complex vehicles and structures that qualify for the same favorable ratings and capital charges as simpler bonds despite potentially holding greater risk. As a result, regulators are planning on making changes to capital charges, reporting requirements and definitions in order to improve transparency and better align the investments with their underlying risk. Included among recent National Association of Insurance Commissioners proposals are: (1) refining the definition of a bond with an eye toward properly classifying and reporting structured securities, including rated notes; (2) revising capital charges assigned to CLOs to eliminate capital arbitrage; and (3) re-examining the quality of private credit ratings from certain rating agencies.

More globally, regulatory developments to keep an eye on include: (1) Solvency II reform in the U.K. aimed at reducing capital requirements and increasing investment in areas such as infrastructure and clean energy; and (2) potential for proposed changes to S&P’s Risk-Based Capital Adequacy model after the previous proposal was withdrawn following significant pushback.

Key takeaways:

- The bond market selloff of 2022 has created a window for insurance investors to lock in attractive yields

- In order to be in a position to best capitalize on these opportunities, companies should ensure that their portfolio maturity structures are aligned with their liabilities

- Alternative fixed income investments continue to generate increased interest from insurers given their enhanced yields and expected returns, diversification benefits and downside protection features

- With the growth in non-traditional assets, insurers need to keep an eye on regulatory developments aimed at improving transparency and better aligning investments with their underlying risk

Illustrative performance data does not represent the performance of actual client portfolios. Trading and other costs have not been deducted from the performance data (e.g. commissions and custodial fees). Illustrative results may differ significantly from actual performance, as there may be variations in the percentage of each security held, the timing of security purchases and sales, and the availability and/or price of a particular security over time as the portfolio does not reflect actual market conditions. Forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. Do not place undue reliance upon such forward-looking statements.

Efforts have been made to ensure that the information contained in this report is obtained from sources believed to be reliable and accurate at the time of publication; however, Sun Life Capital Management (Canada) Inc. and/or its affiliates (collectively “SLC Management”) do not guarantee its accuracy or completeness. Information is subject to change and SLC Management accepts no responsibility for any losses arising from any use of or reliance on the information provided herein.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. These entities are also referred to as SLC Fixed Income and represent the investment grade public and private fixed income strategies in Canada and the U.S.

Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and, in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. In the US, securities are offered by Sun Life Institutional Distributors (U.S.) LLC, an SEC registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”).

The information is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained on this website.

Nothing in this presentation should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

SLC-20230213-2733737